Introduction: The Great Contradiction

Perhaps no religious hypocrisy in the modern world is more transparent, yet more widely accepted, than the institution of “Islamic finance.” Billions of dollars flow annually through products marketed as “sharia-compliant” alternatives to conventional banking, promising Muslims a way to participate in modern financial systems without falling into the prohibited territory of usury. Banks across the globe have established entire divisions dedicated to creating these products, scholars have been employed to issue approving rulings, and an entire industry has emerged to serve the consciences of believers seeking to avoid what the Quran explicitly condemns.

The irony, however, is staggering. The very verse that condemns usury in the Quran specifically identifies the sin of those who “claim that usury is the same as commerce” – yet the entire Islamic finance industry operates on the inverse of this same corruption: claiming that what is functionally identical to interest-bearing transactions is actually “commerce” simply by relabeling the components. The Quran condemns saying “commerce equals usury”; Islamic finance says “usury equals commerce” by putting Arabic names on interest payments. This is not a clever loophole – it is the exact spiritual disease the Quran diagnosed, merely inverted. Both claims represent a fundamental refusal to see the truth: that God has permitted legitimate trade and forbidden exploitative interest, and no amount of creative terminology can transform one into the other.

Part 1: What the Quran Actually Prohibits

Understanding the True Definition of Usury

Before we can expose the farce of Islamic finance, we must first understand what God actually prohibits. The term translated as “usury” in the Quran is “riba” – but what does this really mean? Traditional Muslim scholars have created elaborate definitions, often declaring all interest of any kind to be forbidden. This extreme position has driven the demand for “Islamic” alternatives. However, a careful reading of the Quran, free from the distortions of man-made religious traditions, reveals a more nuanced understanding.

The key verse addressing usury provides crucial context about what constitutes the prohibited practice:

[2:275] “Those who charge usury are in the same position as those controlled by the devil’s influence. This is because they claim that usury is the same as commerce. However, God permits commerce, and prohibits usury. Thus, whoever heeds this commandment from his Lord, and refrains from usury, he may keep his past earnings, and his judgment rests with God. As for those who persist in usury, they incur Hell, wherein they abide forever.”

The footnote to this verse in the Final Testament provides essential clarification: “It is an established economic principle that excessive interest on loans can utterly destroy a whole country. During the last few years we have witnessed the devastation of the economies of many nations where excessive interest is charged. Normal interest—less than 20%—where no one is victimized and everyone is satisfied, is not usury.” This understanding fundamentally changes how we should view modern financial transactions. The prohibition is not against all forms of return on capital, but specifically against excessive, exploitative interest that victimizes borrowers.

Compounded Interest: The True Evil

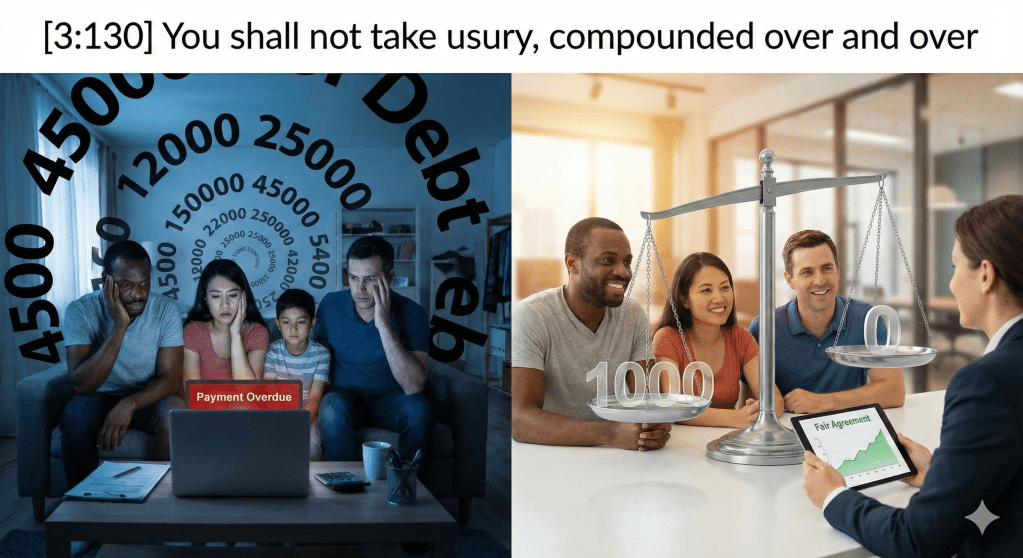

The Quran makes explicit the nature of the usury it condemns through its description of the practice:

[3:130] “O you who believe, you shall not take usury, compounded over and over. Observe God, that you may succeed.”

The phrase “compounded over and over” is crucial. This describes the predatory practice of charging interest upon interest, trapping borrowers in debt spirals from which escape becomes impossible. The footnote to this verse confirms: “Interest on bank deposits and interest charged on loans are lawful if they are not excessive (5-15%). Banks invest and their profits are passed on to the depositors. Since all parties are happy and no one is victimized, it is perfectly lawful to take interest from the bank.” This is not a matter of terminology or structure – it is a matter of whether the transaction exploits and victimizes, or whether it represents a fair exchange where all parties benefit.

Part 2: The Critical Distinction Muslims Have Forgotten

Taking Versus Paying: A Quranic Difference

One of the most significant corruptions that has occurred through the fabricated narrations is the equation of taking interest with paying interest. Traditional Muslim scholarship, based largely on these narrations rather than the Quran, has declared both parties to an interest-bearing transaction equally sinful. This has created enormous hardship for Muslims who need mortgages, car loans, or business financing in societies where such mechanisms are standard. But what does the Quran actually say?

The Quran is remarkably consistent: it condemns those who TAKE usury, not those who are forced by circumstances to pay it. Consider the language of the relevant verses – they consistently address those who “charge” or “take” or “consume” usury. The borrower who has no choice but to accept the terms available in their society is not condemned. As the messenger of the covenant explained: “The Quran is consistent in saying that it is the taking of riba that is haram. When you take interest it is haram, but if you are forced by circumstances to pay interest to anybody you are considered a victim. The Quran considers you a victim – you are not committing a sin.” (at 44:05)

This distinction is enormously important. The corruption through hadith has burdened Muslims with guilt over circumstances they cannot control, driving them toward “Islamic” financial products that are often more expensive and no more ethical than their conventional counterparts. The messenger further clarified: “Of course the hadith will tell you anybody who pays interest is also a sinner. But that’s a hadith, that’s wrong.” (at 44:25) This fabricated addition to God’s law has created a multi-billion dollar industry designed to exploit the guilt of Muslims while delivering products that are functionally identical to what they claim to avoid.

Part 3: The True Definition of Riba

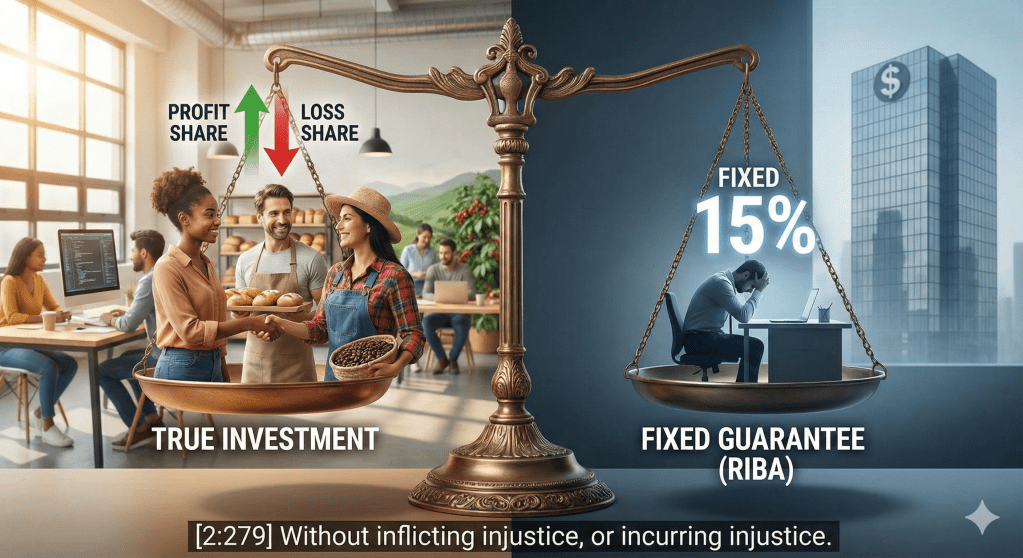

Fixed and Guaranteed: The Real Test

If traditional definitions of riba are corrupted, what is the accurate understanding? The messenger of the covenant provided clear guidance on this question: “Any interest that is fixed and guaranteed is considered usually riba, but if it fluctuates as a result of investing then this is what is halal, what is all right. So the key thing here is fixed and guaranteed – this makes it riba even if it’s 1%, 10%, whatever.” (at 43:35)

This definition cuts to the heart of the matter. The problem with usury is not the concept of earning money from money per se, but the guarantee of fixed returns regardless of the actual economic outcome of the funds. When money is truly invested, it generates returns that fluctuate based on the success or failure of the underlying enterprise. The investor shares in both the risk and the reward. But when money is lent at a guaranteed fixed rate, the lender receives their return regardless of whether the borrower succeeds or fails. This creates a fundamentally exploitative dynamic where the borrower bears all the risk while the lender is guaranteed profit.

Understanding this distinction exposes the fraud of Islamic finance. When an “Islamic” bank provides financing through murabaha (cost-plus financing), they purchase an asset and immediately sell it to the customer at a marked-up price payable in installments. The “profit” they charge is calculated to be equivalent to the prevailing interest rate. If rates are 5%, the markup is around 5%. If rates rise to 8%, the markup rises accordingly. The “profit” is fixed and guaranteed at the outset of the transaction, regardless of any actual business activity or risk-sharing. By the messenger’s definition – which reflects the Quran’s intent – this IS riba, merely wearing different clothes.

Part 4: The Economic Philosophy of True Submission

Trade vs. Usury: God’s Economic Commandment

The Quran establishes a fundamental economic philosophy that distinguishes between productive trade and exploitative usury. As the messenger explained in his teaching on this subject: “Trade is permitted. Usury is forbidden… Usury is lending money at excessive interest and taking advantage of the situation.” (at 1:25:55) This distinction between productive economic activity and exploitation lies at the heart of God’s economic law.

Legitimate commerce involves the exchange of goods and services, the creation of value, and fair dealing between parties. When you buy a product for $10 and sell it for $15, you have added value through your labor, knowledge, risk-taking, and market access. This is fundamentally different from lending $10 and demanding $15 back regardless of any productive activity. The Quran recognizes and honors the difference:

[30:39] “The usury that is practiced to increase some people’s wealth, does not gain anything at God. But if you give to charity, seeking God’s pleasure, these are the ones who receive their reward manifold.”

This verse reveals that usury, despite appearing to increase wealth, gains nothing in God’s sight. The apparent profits are spiritually worthless because they are extracted from others rather than generated through productive activity. The contrast with charity is deliberate – one takes from others to enrich oneself, while the other gives to others seeking only God’s pleasure. The economic system God envisions is one where wealth flows through productive trade and generous charity, not through guaranteed extraction from borrowers.

The Punishment for Violating God’s Economic Law

The consequences of usury are not merely spiritual but manifest in the material world as well. The messenger observed the reality of excessive interest in modern economies: “17 to 18 percent. We’re being punished for this vicious cycle… Inflation and wages go up and inflation goes up. Everybody recognizes that it’s tied to usury. This is one of the strongest statements against something in the Quran. It’s struck by the devil’s touch.” (at 1:01)

The Quran warns that usury ultimately diminishes rather than increases wealth:

[2:276] “God condemns usury, and blesses charities. God dislikes every disbeliever, guilty.”

The messenger elaborated: “There’s absolutely no good that can come at all from usury. Only evil. And God diminishes usury and augments charity. So here we have in the middle of the section on charity something about usury. They’re the opposite of each other. One of them means that not only do you give a man money, not only do you want it back, but you want more of it back than you gave him. Charity means you’re giving a man money and you don’t even want it back.” (at 1:41) This contrast reveals the spiritual and economic opposition between exploitative lending and generous giving.

Part 5: How “Islamic Finance” Actually Works

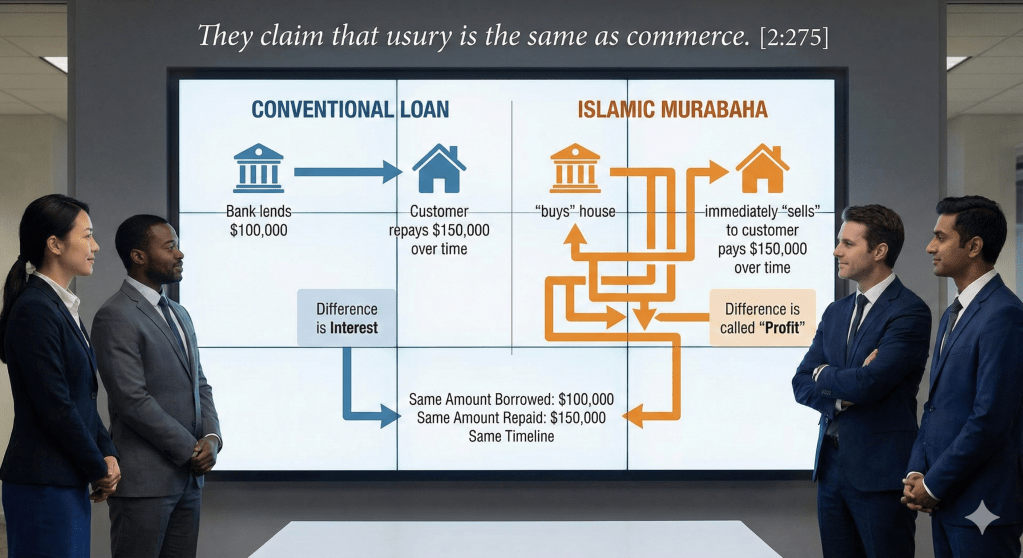

Murabaha: Interest by Another Name

The most common “Islamic” financing product is murabaha, or “cost-plus” financing. In a conventional loan, a bank lends you $100,000 to buy a house, and you repay $150,000 over time – the extra $50,000 being interest. In murabaha, the bank supposedly “purchases” the house for $100,000 and immediately “sells” it to you for $150,000 payable in installments. The bank claims there is no interest involved – merely a legitimate “profit” from a sale transaction.

The farce is immediately apparent. The bank has no genuine commercial interest in the property. They do not take possession, they do not assume ownership risk, they do not engage in any actual trading activity. The entire “purchase and sale” occurs simultaneously in paperwork only. The “profit” charged is calculated precisely to match prevailing interest rates. If market interest rates are 6%, the murabaha “profit” is 6%. If rates rise to 8%, the profit rises accordingly. The bank has simply relabeled “interest” as “profit” and “lending” as “selling” while the economic substance remains identical.

Worse, murabaha financing often costs MORE than conventional loans because of the additional legal and administrative complexity of maintaining the fiction of a “sale” transaction. Muslims pay a premium for the privilege of receiving a product that is functionally identical to what they sought to avoid. The banks profit both from the interest-equivalent charges AND from the premium Muslims pay for their guilty consciences. This is not honoring God’s law – it is exploiting sincere believers’ desire to obey God while delivering the exact opposite of what was promised.

Tawarruq and Sukuk: Increasing Complexity, Same Substance

When murabaha became too obviously equivalent to interest-bearing loans, Islamic finance developed more elaborate structures. Tawarruq (organized commodity trading) involves a series of instantaneous commodity purchases and sales designed to convert what is obviously a cash loan into a chain of “commodity trades.” The borrower ends up with cash and an obligation to repay more cash later – exactly like a conventional loan – but through a circuitous route involving metals or other commodities that are bought and sold in fractions of seconds without ever being physically delivered.

Sukuk, often called “Islamic bonds,” are similarly elaborate constructions. A conventional bond involves lending money to a corporation or government and receiving periodic interest payments plus return of principal. Sukuk supposedly involves “investing” in assets and receiving “rental income” or “profit shares” rather than interest. But the returns are structured to exactly match bond yields, the principal is guaranteed, and the “assets” involved often have no genuine connection to the payments received. The complexity serves only to create plausible deniability for what is functionally identical to conventional bonds.

Part 6: The Inversion of 2:275

The Original Sin: “Usury is Like Commerce”

The key to understanding the profound corruption of Islamic finance lies in carefully reading verse 2:275. God condemns those who “claim that usury is the same as commerce.” This was the argument of the usurers of old – they claimed that lending at interest was just another form of business, no different from buying and selling goods. Their position was: “What’s the difference? Commerce involves making profit, and so does lending at interest. They’re the same thing.”

God explicitly rejected this argument. Commerce and usury are NOT the same. Commerce involves productive activity, the exchange of goods and services, the assumption of risk, the creation of value. Usury involves extracting guaranteed returns from those in need, regardless of productive activity, without sharing in risk. The usurers of old conflated these distinct activities to justify their exploitation.

But observe what Islamic finance does: it takes the SAME logical fallacy and simply inverts it. Where the ancient usurers said “usury is like commerce” to justify interest, Islamic finance says “our commerce is NOT usury” while engaging in transactions that are functionally identical to interest-bearing loans. The argument has been flipped, but the underlying corruption is identical. Both claims deny the clear distinction God made between legitimate trade and exploitative lending.

The Same Spiritual Disease, Different Symptoms

Consider the spiritual dynamic at work. The usurers condemned in the Quran knew they were charging interest – they simply argued it was acceptable because it was “just business.” Modern Islamic finance practitioners also charge what amounts to interest, but they claim it’s acceptable because they’ve called it something else and structured the transaction with additional steps. Both groups are engaging in the same fundamental dishonesty: claiming that what God prohibited is actually what God permitted.

The ancient usurer said: “My interest is really just commerce” (trying to relabel usury as trade).

The modern “Islamic” banker says: “My commerce is definitely not interest” (trying to relabel trade-structured-interest as legitimate profit).

Both are trying to obscure the substance of their transactions with word games. Both are claiming that the distinction God made between commerce and usury can be manipulated through clever definitions. And both are condemned by the same verse – for the verse condemns not a specific direction of the claim, but the very act of conflating what God has separated.

[2:278] “O you who believe, you shall observe God and refrain from all kinds of usury, if you are believers.”

The command is to refrain from “all kinds” of usury. This includes usury that has been relabeled, restructured, certified by scholars, and marketed as compliant. If the substance is the same – if you are borrowing money and returning more money with a fixed, guaranteed “profit” for the lender – then you are engaged in usury regardless of what you call it. The command is to refrain, not to rename.

Part 7: The Economic Reality

Islamic Finance Charges the Same or Higher Rates

If Islamic finance were truly different from conventional banking, we would expect to see different pricing. Risk-sharing should lead to different return profiles than fixed interest. Genuine investment in productive activity should yield different results than guaranteed lending. But the reality is that Islamic financial products are priced to match conventional products – and often cost more.

Studies consistently show that murabaha financing costs are equivalent to or higher than conventional mortgage rates in the same markets. Sukuk yields track conventional bond yields almost perfectly. Islamic credit cards charge “profit rates” that mirror interest rates. This pricing equivalence is not coincidental – it’s structural. Islamic banks benchmark their “profit rates” to LIBOR or other interest rate indices. When setting murabaha margins, they calculate what interest rate would be charged conventionally and set their “profit” accordingly.

This benchmarking to interest rates reveals the truth: Islamic finance is not offering an alternative to interest-based finance but rather repackaging it. The messenger observed the consequences of high interest rates: “You can make 20% loaning your money out and there’s no risk because you’ve got a guaranteed piece of paper. It’s better to do that than to set up a business and employ people to make the same amount of money.” (at 3:48) The same dynamic exists in Islamic finance – the “profits” are guaranteed regardless of productive activity, creating the same perverse incentives.

The Poor Are Still Exploited

The Quran’s concern with usury is fundamentally about exploitation – about those with capital extracting wealth from those without, regardless of circumstances or outcomes. A truly ethical alternative to usury would prioritize protection of the vulnerable over profit extraction. Yet Islamic finance products are designed primarily to replicate conventional returns for investors while providing legal cover for borrowers. The actual welfare of the poor is secondary at best.

In many Muslim-majority countries, the poor have even less access to Islamic finance than to conventional banking. The legal complexity and higher administrative costs make Islamic products less economically viable for small loans. Microfinance through Islamic structures is often more expensive than secular alternatives. The result is that Islamic finance primarily serves the wealthy who can afford the premium pricing and legal complexity, while the poor continue to be exploited by whatever lenders will serve them.

[2:279] “If you do not, then expect a war from God and His messenger. But if you repent, you may keep your capitals, without inflicting injustice, or incurring injustice.”

The standard is clear: “without inflicting injustice, or incurring injustice.” A financial system that charges the poor higher rates, extracts guaranteed returns from borrowers regardless of their circumstances, and primarily serves the wealthy is not avoiding injustice – it is systematizing it under a religious label.

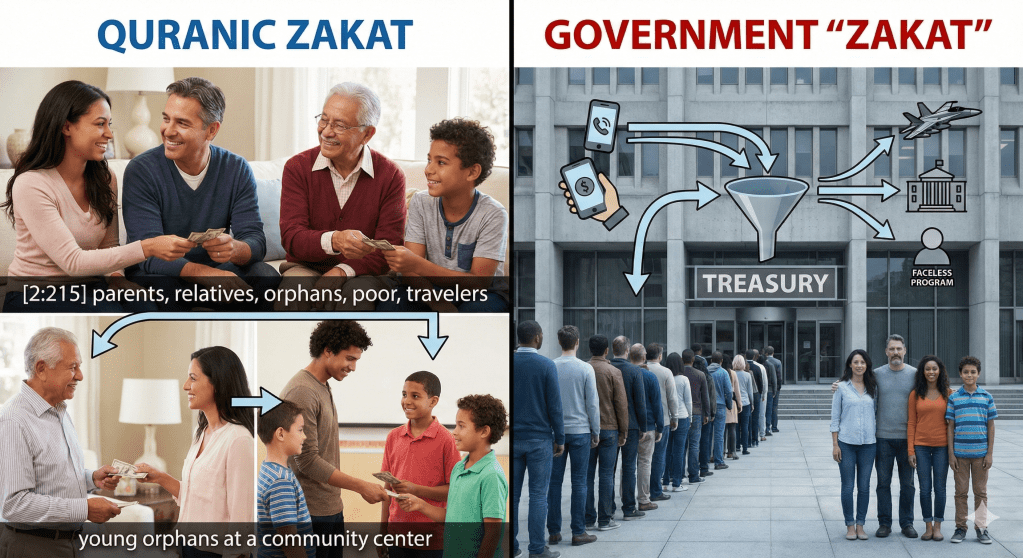

Part 8: The Zakat Farce – Taxation Disguised as Charity

When Governments Hijack God’s Commandment

The corruption of Islamic finance extends far beyond interest-bearing products relabeled as “profit.” Perhaps equally egregious is the systematic abuse of “zakat” – the obligatory charity – which Muslim governments have transformed from a personal act of worship into a state-controlled tax system. Countries like Saudi Arabia, Malaysia, and Pakistan collect “zakat” through government agencies, claiming religious authority while violating virtually every Quranic requirement for this sacred obligation.

The Quran is explicit about when and how zakat must be given:

[6:141] “He is the One who established gardens, trellised and untrellised, and palm trees, and crops with different tastes, and olives, and pomegranate—fruits that are similar, yet dissimilar. Eat from their fruits, and give the due alms on the day of harvest, and do not waste anything. He does not love the wasters.”

The footnote to this verse exposes the corruption directly: “Zakat charity is so important, the Most Merciful has restricted His mercy to those who give it (7:156). Yet, the corrupted Submitters have lost this most important commandment; they give Zakat only once a year. We see here that Zakat must be given away ‘On the day we receive income.’ The proportion that came to us through Abraham is 2.5% of one’s net income.” Notice: “the corrupted Submitters” – not unbelievers, but those claiming to follow Islam while distorting its requirements.

How Muslim Countries Corrupt Every Aspect of Zakat

The Quranic zakat has specific requirements that government “zakat” programs systematically violate:

1. Timing Corruption: The Quran commands giving “on the day of harvest” – meaning immediately upon receiving income. Yet Muslim countries collect zakat annually, often deducted automatically like any other tax. This is not a minor difference in implementation – it transforms a continuous act of worship into an annual administrative burden, disconnecting the giver from the spiritual significance of immediate generosity.

2. Recipient Corruption: The Quran specifies exactly who should receive zakat and in what order:

[2:215] “They ask you about giving: say, ‘The charity you give shall go to the parents, the relatives, the orphans, the poor, and the traveling alien.’ Any good you do, God is fully aware thereof.”

The order is significant: parents first, then relatives, then orphans, then the poor, then travelers. This is personal, direct charity that strengthens family bonds and community ties. Government zakat programs ignore this entirely – your zakat goes into state coffers to be distributed according to bureaucratic priorities, often funding government programs that have nothing to do with the Quranic categories. Your elderly parents and struggling relatives receive nothing while the state claims to have fulfilled your religious obligation.

3. Category Corruption: While the Quran in verse 9:60 lists specific categories for charity distribution, governments expand these definitions to include virtually any state spending they wish to justify:

[9:60] “Charities shall go to the poor, the needy, the workers who collect them, the new converts, to free the slaves, to those burdened by sudden expenses, in the cause of God, and to the traveling alien. Such is God’s commandment. God is Omniscient, Most Wise.”

Notice: “Such is God’s commandment” – not a suggestion, not a guideline, but a commandment. Yet governments claim that “in the cause of God” can mean military spending, infrastructure projects, or whatever serves state interests. The clear, specific categories are expanded into vague justifications for any government program.

The Same Pattern: Relabeling to Circumvent God’s Law

The zakat corruption follows the exact same pattern as the “Islamic finance” corruption. Just as banks relabel interest as “profit” while maintaining the same exploitative structure, governments relabel taxation as “zakat” while maintaining the same coercive collection and state-directed spending. In both cases, Arabic religious terminology is used to provide Islamic cover for practices that violate the clear Quranic requirements.

The messenger’s commentary on the importance of zakat emphasizes its connection to God’s mercy:

[7:156] “…My mercy encompasses all things. However, I will specify it for those who (1) lead a righteous life, (2) give the obligatory charity (Zakat), (3) believe in our revelations…”

The footnote reinforces: “The importance of the obligatory charity (Zakat) cannot be over emphasized. As instituted in 6:141, Zakat must be given away upon receiving any income—2.5% of one’s net income must be given to the parents, the relatives, the orphans, the poor, and the traveling alien, in this order.” The order matters. The timing matters. The personal, direct nature of the giving matters. All of this is lost when governments transform zakat into another tax.

The Packaging of Corruption as Righteousness

What makes this corruption particularly insidious is how it is packaged as religious duty. Muslims in these countries are told they are fulfilling their Quranic obligation by paying government zakat, when in reality they are doing nothing of the sort. The state has taken a personal act of worship and transformed it into compulsory taxation while claiming religious legitimacy.

This is the broader pattern throughout the Muslim world: take clear Quranic commandments, strip them of their actual requirements, relabel secular practices with Arabic religious terminology, and present the corrupted version as authentic Islam. “Islamic banking” that charges interest. “Zakat” that goes to government coffers. “Sharia law” based on fabricated narrations rather than Quran. In every case, the pattern is identical: the Arabic label provides religious cover while the substance contradicts the Quranic guidance.

The irony is profound. Muslims are taught that their religion requires these corrupted institutions, when the Quran they claim to follow condemns exactly what these institutions do. They pay premium prices for “Islamic” products that are functionally identical to conventional ones. They have their zakat seized by governments that ignore the Quranic distribution requirements. And they are told this is righteousness.

Part 9: Fatwa Shopping and the Corruption of Scholarship

Scholars for Sale

The Islamic finance industry could not exist without religious scholars willing to certify products as “sharia-compliant.” These scholars sit on “sharia boards” of Islamic banks, reviewing product structures and issuing approving opinions (fatwas). They are paid handsomely for this service – often serving on multiple boards simultaneously, creating conflicts of interest and incentives to approve products that would otherwise be questionable.

This system of “fatwa shopping” allows banks to create products designed for profit and then find scholars willing to approve them. If one scholar objects to a structure, another can be found who will accept it – perhaps with minor modifications that change the appearance without affecting the substance. The result is a race to the bottom in scholarly standards, where the most permissive interpretations become industry standard because they allow the most profitable products.

The messenger spoke clearly about the corruption of religious authority through man-made traditions: “We know now from many, many years of research that the hadith are fabrications attributed to the prophet.” (at 16:16) The same dynamic that led to the fabrication of hadith – religious authorities creating rules beyond what God revealed – continues today in the Islamic finance industry. Scholars issue rulings based on technical formalities rather than the clear substance of Quranic guidance, just as earlier scholars created entire bodies of “religious law” from fabricated sources.

The Fiction of “Sharia Compliance”

The very concept of “sharia compliance” in Islamic finance is problematic. The scholars approving these products are evaluating them against fiqh (jurisprudence) traditions that themselves may be based on corrupted sources. When a scholar certifies a murabaha product as “compliant,” they are saying it meets the technical requirements of their school of jurisprudence – not necessarily that it reflects the actual guidance of the Quran.

The Quran’s guidance on usury is clear: don’t charge it, especially the compounding kind that traps borrowers. Don’t exploit those in need. Engage in legitimate trade where all parties benefit. Share in risk rather than extracting guaranteed returns. A product that violates all of these principles cannot become compliant simply because a scholar says the paperwork is in order.

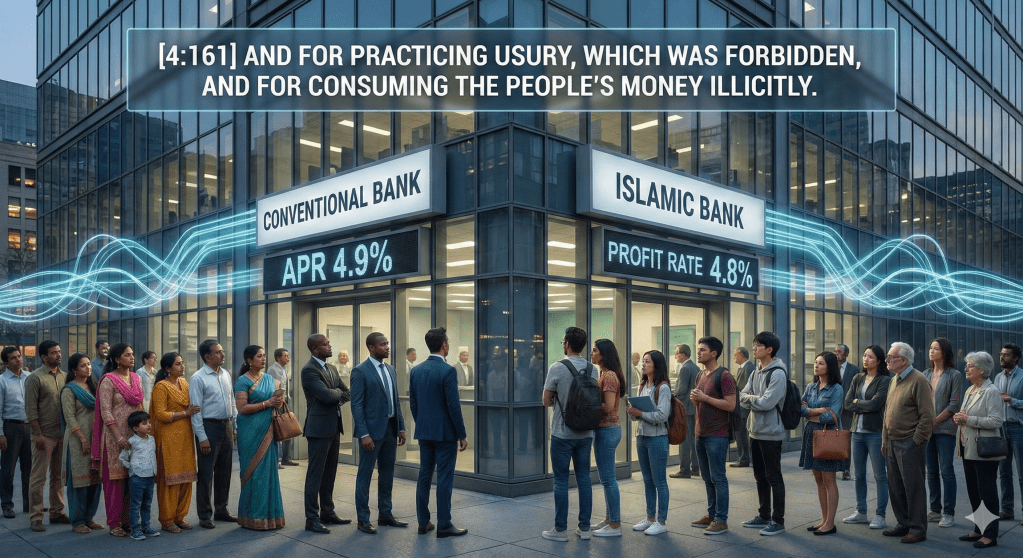

[4:161] “And for practicing usury, which was forbidden, and for consuming the people’s money illicitly. We have prepared for the disbelievers among them painful retribution.”

This verse addresses those who practiced usury despite knowing it was forbidden. The scholars who approve products that are functionally identical to usury, knowing full well what they are doing, bear responsibility for this corruption. The painful retribution mentioned applies not only to those who charge usury but to those who enable and justify it while claiming religious authority.

Part 10: What True Submission Requires

Honesty Before God

The foundation of submission to God is honesty – with oneself, with others, and with God. The entire Islamic finance industry is built on a foundation of dishonesty: pretending that transactions are something other than what they actually are. A murabaha is called a “sale” when everyone involved knows it is a loan. A sukuk is called an “investment” when everyone involved knows the principal is guaranteed. This systematic dishonesty cannot please God regardless of how many scholars approve it.

If you are borrowing money and returning more money, with the additional amount fixed at the outset regardless of how the money is used – that is interest, whether you call it “profit,” “markup,” “rental,” or anything else. If you are lending money and receiving guaranteed returns regardless of any productive activity – that is usury, whether structured through commodity trades, property purchases, or any other mechanism. True submission requires acknowledging what things actually are, not hiding behind legal fictions.

The messenger taught: “If you buy a house, the only way to buy a house is to have a mortgage on it and pay exorbitant interest. Then you are a victim.” (at 27:40) This acknowledges the reality that in modern economies, avoiding interest entirely may be impossible for ordinary people. The answer is not elaborate fictions that pretend to avoid interest while delivering the same economic substance. The answer is honest acknowledgment of one’s circumstances while seeking to minimize exploitation where possible.

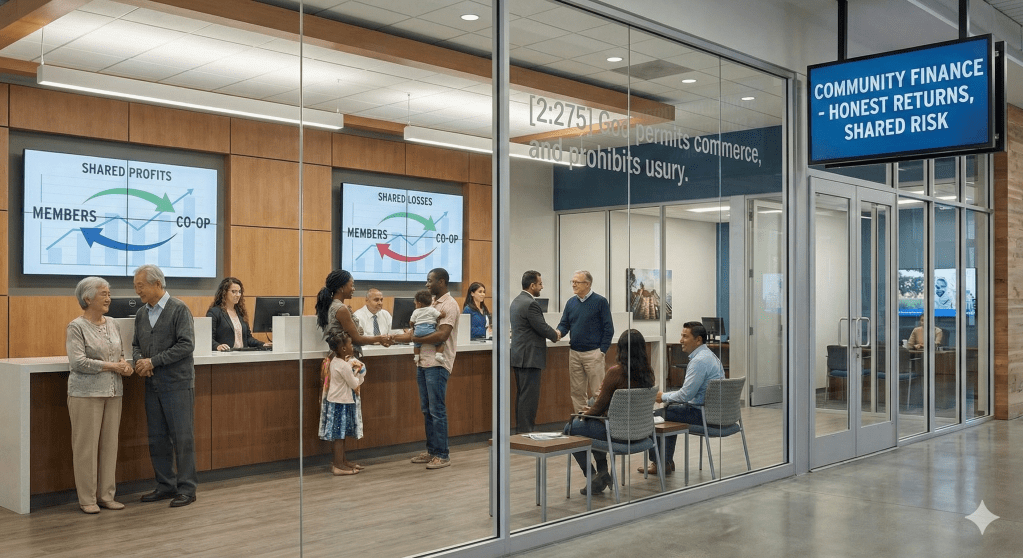

The Path Forward

What would a genuinely ethical approach to finance look like for those who submit to God? It would begin with honesty: if you are paying interest, call it interest. If you are receiving interest, call it interest. This honesty is the first step toward addressing the actual issues the Quran raises.

Second, it would focus on the substance rather than the form. The Quran’s concern is with exploitation, not terminology. A financial arrangement where all parties genuinely benefit, where risk is appropriately shared, where no one is victimized by excessive charges or compounding debt – this may be acceptable even if it involves what would technically be called “interest.” An arrangement that extracts guaranteed returns from vulnerable borrowers through complex structures is usury even if every scholar in the world approves the paperwork.

Third, it would prioritize genuine risk-sharing and productive investment. True alternatives to usury exist – equity investment in real businesses, profit-sharing arrangements where returns depend on actual outcomes, cooperative structures where all participants share in both gains and losses. These are harder to structure and market than repackaged loans, but they actually reflect the Quranic distinction between legitimate commerce and exploitative usury.

Part 11: The War from God

Economic Consequences of Systematic Usury

The Quran warns of “a war from God and His messenger” for those who persist in usury after being warned. This is not merely a threat of punishment in the afterlife – it manifests in the material consequences of usury-based economic systems. The messenger observed these consequences in modern economies:

“All the economic problems in this country is interest. They complain about inflation, but when you buy a house that’s $50,000 for example, and when you calculate after 30 years of paying for it, interest and everything, the actual price is $150,000, not $50,000. So where do the $100,000 go? $100,000 will go to employees and salaries and tall buildings. The skyscrapers in every city are home federal savings.” (at 4:15)

The concentration of wealth in financial institutions that produce nothing of value while extracting guaranteed returns from those who actually work and produce – this is the “war from God” manifesting economically. The 2008 financial crisis, driven by complex interest-bearing instruments that collapsed when borrowers could no longer pay, was a vivid demonstration of how usury-based systems ultimately destroy themselves. And tragically, Islamic finance was no protection – institutions that had claimed to offer ethical alternatives collapsed alongside their conventional counterparts because the underlying structures were the same.

[2:279] “If you do not, then expect a war from God and His messenger.”

This warning applies equally to those who charge usury directly and those who do so through elaborate structures designed to disguise the practice. The war comes regardless of what label you put on your exploitation. God is not fooled by terminology.

Spiritual Consequences of Religious Hypocrisy

Beyond economic consequences, the farce of Islamic finance represents a profound spiritual corruption. Muslims who sincerely seek to follow God’s guidance are directed toward products marketed as religious alternatives, only to receive the same exploitation under a different name. Their sincere intention to obey God is exploited for profit by institutions that know full well they are delivering conventional products in Islamic wrapping.

The damage to faith is substantial. Many Muslims eventually realize that their “Islamic” mortgage is economically identical to a conventional mortgage. Some conclude that religious guidance is irrelevant to modern life. Others become cynical about religious authorities who approved these products. Still others double down on the pretense, refusing to acknowledge what they can see with their own eyes because doing so would require admitting they were deceived.

The Quran repeatedly emphasizes that God is not fooled by appearances or intentions disconnected from actions. You cannot claim to avoid usury while engaging in usury under another name. You cannot claim submission while refusing to acknowledge the truth of your situation. You cannot claim righteousness while profiting from the deception of sincere believers.

Part 12: Reclaiming Quranic Guidance

Beyond the False Choice

The Islamic finance industry has presented Muslims with a false choice: either use their products and remain “compliant,” or use conventional products and sin. But this choice assumes their products are actually different – an assumption that collapses under examination. The true choice is not between Islamic and conventional finance, but between honesty and deception about what one is actually doing.

The Quran’s guidance on usury is not about creating an alternative financial system for Muslims – it is about establishing just economic relationships between all people. The exploitation condemned in the Quran occurs in both “Islamic” and conventional finance when vulnerable borrowers are charged excessive, compounding interest from which they cannot escape. Legitimate return on investment is permitted in both systems when it reflects genuine risk-sharing and productive activity.

A Muslim who takes a conventional mortgage with a reasonable interest rate, acknowledging honestly what they are doing and why, is in a better position spiritually than one who takes an “Islamic” mortgage at the same or higher rate while pretending it is something different. The first is honest about their circumstances; the second is participating in a religious fiction that corrupts both their understanding and their community’s institutions.

Practical Guidelines from Quranic Principles

What does the Quran’s guidance actually require in practical terms?

First, avoid TAKING usury – especially the compounding, exploitative kind. If you have savings, seek investments that involve genuine risk-sharing rather than guaranteed returns extracted from borrowers. This is difficult in modern financial systems, but awareness of the principle can guide better choices even if perfection is impossible.

Second, understand that PAYING interest when necessary does not make you a sinner – it makes you a victim of systems you cannot control. Do not add to your burden by paying extra for “Islamic” products that deliver the same economic substance. Focus on minimizing exploitation through shopping for reasonable rates, avoiding unnecessary debt, and paying off obligations as quickly as possible.

Third, advocate for genuinely ethical alternatives. True risk-sharing arrangements, cooperative financial structures, community-based lending – these reflect Quranic principles better than elaborate fictions designed by lawyers and approved by paid scholars. Support institutions that actually operate differently, not those that merely claim to.

Fourth, maintain honesty in all dealings. If you are borrowing money and returning more, acknowledge that reality. If you are investing and expect returns, acknowledge the risk involved. Do not pretend that transactions are something other than what they are. God knows the truth regardless of what we call things.

Conclusion: True Submission Requires Truth

The Islamic finance industry represents one of the most successful religious marketing schemes in modern history. It has convinced millions of Muslims to pay premium prices for products that deliver the same economic substance as what they claim to avoid, all while enriching banks, lawyers, and scholars who profit from the deception. The tragedy is not merely economic – it is spiritual. Sincere believers seeking to follow God’s guidance have been led into a system of elaborate fictions that corrupts their understanding of both finance and faith.

The Quran’s condemnation of those who “claim that usury is the same as commerce” applies with equal force to those who claim that commerce-structured-usury is not really usury. Both claims represent the same spiritual disease: the attempt to obscure the clear distinction God made between legitimate trade and exploitative lending. Whether you argue that your usury is really commerce, or that your commerce-wrapped-usury is definitely not usury, you are playing the same word game with the same God who sees all things as they truly are.

True submission requires truth. It requires acknowledging what transactions actually are, not hiding behind legal fictions. It requires focusing on the substance of economic relationships – whether they exploit or benefit, whether they share risk or extract guaranteed returns, whether they victimize or serve. It requires the humility to admit when circumstances force us into imperfect choices, rather than pretending that expensive Islamic products magically transform sin into compliance.

The path forward is not more elaborate fictions or more permissive scholars. It is radical honesty: about what we are actually doing, about what the Quran actually prohibits, and about whether our actions align with our claimed beliefs. This honesty is uncomfortable. It does not come with sharia certificates or approval from religious authorities. But it is the only foundation for genuine submission to God – the only relationship that matters when all human institutions, including Islamic finance, fade away.

[2:275] “God permits commerce, and prohibits usury. Thus, whoever heeds this commandment from his Lord, and refrains from usury, he may keep his past earnings, and his judgment rests with God.”

The judgment rests with God – not with scholars, not with marketing departments, not with sharia boards. Every person will stand before their Lord and account for what they actually did, not what they claimed to do. On that day, no elaborately structured product will provide shelter, and no certificate of compliance will matter. What will matter is whether we heeded God’s clear commandment or spent our lives playing word games to avoid it.

Let us choose honesty. Let us choose truth. Let us choose genuine submission over religious theater. The reward for this choice may not come from the Islamic finance industry, but it will come from the One whose pleasure we actually seek.

Leave a comment